Nearshoring to Eastern Europe

A Strategic Imperative for US and Canadian Businesses in an Era of Global Uncertainty

The current global economic and political landscape is characterized by a high degree of volatility and unpredictability. The resurgence of trade wars, persistent geopolitical conflicts spanning Ukraine, Gaza, and the India-Pakistan border, coupled with significant disruptions to global supply chains such as the Red Sea crisis, have created a challenging environment for businesses worldwide. In response to these mounting pressures, many North American companies are increasingly considering nearshoring as a strategic alternative to traditional offshoring or domestic operations. Nearshoring, the practice of relocating business functions to geographically proximate countries, offers a compelling balance between cost efficiency and risk mitigation. This article argues that Eastern Europe has emerged as a particularly attractive nearshoring destination for US and Canadian businesses, providing a unique combination of economic stability, skilled labor, competitive costs, and favorable logistical and cultural alignment. Specializing in facilitating this transition, our company offers comprehensive services in pod creation, staff augmentation, and recruiting, positioning us as a key partner for North American enterprises seeking to establish a robust and resilient presence in Eastern Europe.

The Imperative for Nearshoring - Navigating Global Disruptions

The confluence of recent trade policy shifts in North America, escalating geopolitical tensions, and growing challenges in global logistics has created a compelling case for US and Canadian businesses to seriously consider nearshoring strategies.

The Impact of US and Canadian Trade Policies on Business Strategies

The trade policies enacted by the United States, particularly the tariffs imposed under the Trump administration, represent a significant shift towards protectionism with far-reaching implications for global trade. A 10% tariff on goods from nearly all countries was introduced with the aim of addressing trade deficits and protecting domestic industries. This broad measure affects a vast array of imported goods, thereby increasing procurement costs for numerous businesses that rely on international supply chains. This universal tariff necessitates a comprehensive re-evaluation of sourcing strategies for companies in North America that have historically benefited from lower-cost imports from various regions.

The economic effects of these tariffs are already being felt across the business landscape. The average effective US tariff rate has reached its highest point since 1909, leading to an estimated average annual loss of $3,800 per household. Businesses are increasingly concerned about the impact of these tariffs, with over 30% identifying trade and tariffs as their most pressing business concern. The anticipation of further cost increases has even led to a surge in imports as companies attempt to get ahead of the levies. This indicates a direct and substantial financial burden on both businesses and consumers due to the current trade policies.

Furthermore, the tariffs imposed by the US have been met with retaliatory measures from key trading partners. China, Canada, and the European Union have announced or implemented tariffs on US exports, affecting a substantial $330 billion worth of goods. Canada, in particular, has responded with tariffs on US imports in direct response to US levies on steel, aluminum, and automobiles. These retaliatory actions create a cycle of trade disputes that further disrupt established trade flows and negatively impact businesses on both sides of these trade relationships, making it more expensive for US companies to export their products and potentially leading to decreased demand and lost market share.

The close economic integration between the US and Canada makes Canadian businesses particularly vulnerable to changes in US trade policy. US tariffs directly increase the cost of Canadian goods entering the US, leading to decreased demand for Canadian exports in key sectors such as manufacturing, energy, and agriculture. The Bank of Canada has even warned that a drop in exports could weaken Canada’s GDP and slow overall economic growth. Canada’s own retaliatory tariffs on US goods further complicate this intricate trade relationship.

Geopolitical Instability and its Repercussions on Supply Chains

The ongoing war in Ukraine has introduced significant instability into global supply chains, disrupting the flow of essential commodities such as energy, metals, oil, and agricultural products. This conflict has not only led to increased prices and shortages in these sectors but has also caused transportation problems and delays in established trade routes. The imposition of sanctions against Russia by numerous countries further complicates the already strained supply chains.

The conflict in Gaza represents another source of instability in the global landscape, contributing to increased volatility in financial markets and higher energy prices. The potential for disruptions to energy supplies from the Middle East, a strategically crucial region for global energy production, can lead to significant price fluctuations. Furthermore, the conflict can disrupt trade routes and create logistical challenges for businesses operating in or trading with the affected region.

Escalating tensions between India and Pakistan also pose a risk to international business. The suspension of bilateral trade between the two nations, coupled with disruptions in transportation, including air travel, has already been observed. The potential for a broader conflict raises concerns about regional stability and could lead to inflationary pressures, particularly in energy markets, given India’s reliance on oil imports. Specific industries, such as textiles and pharmaceuticals, are also facing impacts due to this regional conflict.

The Growing Challenges of Global Logistics

The crisis in the Red Sea has further underscored the fragility of global shipping and the significant economic consequences of disruptions to key maritime trade routes. Attacks on commercial vessels have forced major shipping companies to reroute their ships around Africa’s Cape of Good Hope, leading to a substantial decrease in traffic through vital waterways like the Suez Canal and the Bab el-Mandeb Strait. The increased voyage times and distances have resulted in a dramatic surge in freight costs and insurance premiums, causing delays and disruptions across various industries.

Beyond geopolitical events, a confluence of other factors is contributing to the complexity and unreliability of global logistics. Labor disputes leading to strikes in key transportation sectors have caused significant delays and disruptions. Additionally, the increasing frequency and intensity of climate-related disasters pose a growing threat to supply chains, impacting transportation routes and infrastructure. These factors, combined with port congestion and other logistical bottlenecks, create a challenging environment for businesses relying on long, global supply chains.

Eastern Europe - A Strategic Anchor for Nearshoring

In the face of these global disruptions, Eastern Europe has emerged as a strategic and increasingly attractive destination for North American businesses seeking to nearshore their operations. The region offers a unique blend of economic resilience, a skilled workforce, competitive labor costs, and favorable logistical and cultural alignment.

Economic Resilience and Growth Potential in Eastern Europe

Central and Eastern Europe (CEE) is experiencing robust economic growth dynamics, often outpacing the growth rates of Western European economies. This strong economic performance indicates that the region possesses solid underlying fundamentals and a significant potential for sustained growth, making it an appealing destination for business investment. Furthermore, the Eastern European tech market has demonstrated remarkable resilience in navigating geopolitical complexities and adapting to rapid technological advancements. This ability to withstand external pressures and embrace innovation signals a stable and future-ready environment for companies seeking reliable nearshoring partners.

Multiple economic forecasts project continued GDP growth for Eastern European countries in the coming years. For instance, average growth for EU members in the CEE region is forecasted at 2.8% for 2025, and specific countries like Hungary and the Czech Republic are predicted to see GDP growth of 1.8% and 2.4% respectively in 2025. These positive outlooks, even amidst global uncertainties, provide confidence in the region’s economic trajectory and its suitability for long-term business partnerships.

Examining the latest inflation data for key Eastern European countries reveals that while price levels are increasing, the rates are generally manageable. For January 2025, Poland recorded an annual inflation rate of 4.3%, Romania 5.3%, the Czech Republic 2.9%, and Bulgaria 3.8%.61 While these figures indicate the presence of inflation, they are not excessively high compared to other regions, suggesting a relatively stable pricing environment for businesses operating in or nearshoring to Eastern Europe.

Moreover, the consistently low unemployment rates across key Eastern European countries point to a readily available workforce. In March 2025, Poland’s unemployment rate stood at 2.6%, Romania’s at 5.5%, the Czech Republic’s at 2.6%, and Bulgaria’s at 3.8%. These figures, often below the EU average, indicate a strong labor market with a pool of available talent for businesses seeking to expand their operations in the region.

A Deep Dive into the Region's Skilled Workforce and Competitive Labor Costs

`Central and Eastern Europe (CEE) boasts a substantial and rapidly growing pool of information and communication technology (ICT) specialists, with over 3.5 million employed in the region as of 2025. This makes CEE the largest subregional tech talent pool globally, surpassing even India and Latin America in sheer size. This vast talent pool offers North American companies a significant advantage in finding skilled professionals to meet their technology needs.

The region’s strong emphasis on STEM (Science, Technology, Engineering, and Mathematics) education ensures a continuous supply of highly qualified graduates entering the workforce. Eastern European universities produce approximately 80,000 STEM graduates annually, and the World Economic Forum indicates that Eastern Europe has one of the highest shares of STEM graduates worldwide. This focus on technical education guarantees a consistent influx of skilled workers in fields critical to technology and innovation.

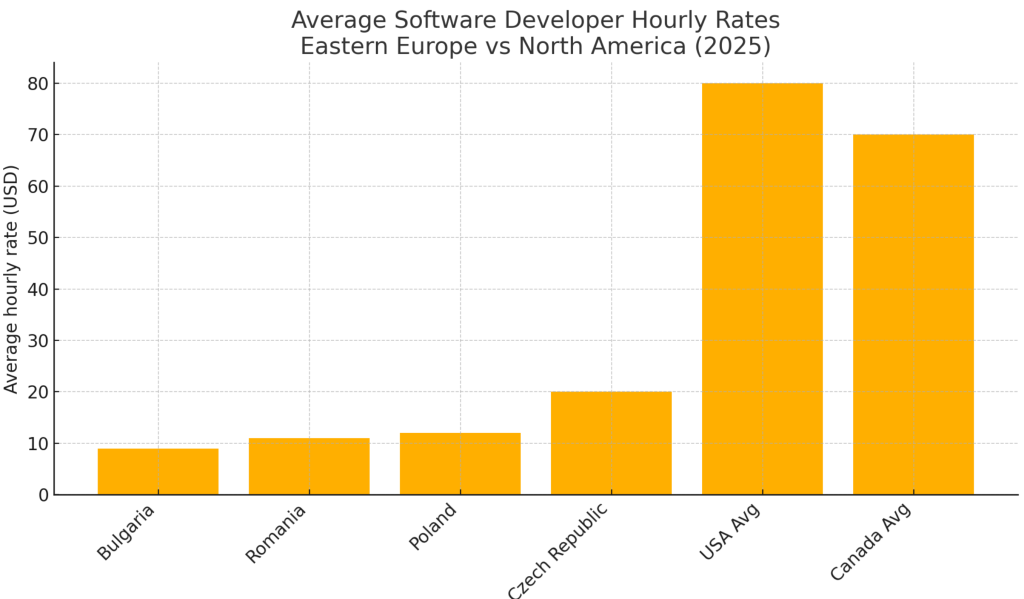

One of the most compelling advantages of nearshoring to Eastern Europe is the significant cost savings in terms of labor. Average hourly rates for software developers in Eastern Europe range from approximately $8.95 in Bulgaria to $19.63 in the Czech Republic, which is considerably lower than the average hourly rates in North America, where they can range from $45 to $200 or more. This cost disparity allows US and Canadian companies to achieve substantial savings on their development expenses while still accessing a highly skilled workforce.

Beyond the IT sector, Eastern Europe also offers a skilled and cost-competitive workforce in manufacturing. Labor costs in countries like Poland, Romania, and Bulgaria are significantly lower than in Western Europe, making the region an attractive destination for North American companies looking to nearshore their manufacturing operations and reduce expenses.

Furthermore, Eastern Europe provides a readily available pool of customer service professionals with strong language skills and competitive salary expectations. Countries like Poland and Bulgaria have a substantial workforce proficient in multiple languages, including English. The average annual salary for a customer service representative in Poland is approximately USD 16,947, and in Bulgaria around USD 10,546 97, which is significantly lower than in the US or Canada.

Bridging the Time Zone Gap - Facilitating Seamless Collaboration

The time difference between Eastern Europe and North America, while not negligible, still allows for a manageable overlap in working hours, particularly with the US East Coast. Eastern Europe is typically 6 to 10 hours ahead of the US, resulting in a 2-4 hour window of shared working time. While the US West Coast has a larger time difference, the 2-4 hour overlap with the East Coast still provides a valuable opportunity for real-time communication, meetings, and collaborative problem-solving on critical tasks.

This geographical proximity and the resulting ability to have overlapping work hours facilitate seamless communication and collaboration between North American and Eastern European teams. The manageable time difference allows for easier scheduling of meetings and real-time discussions, which is essential for effective project management and team integration. The close proximity also enables easier and more affordable travel for in-person meetings when necessary.

Cultural Alignment - Fostering Stronger Business Relationships

Eastern European business culture shares several similarities with that of North America, particularly in communication styles and work ethics. The dominant style of communication in both regions tends to be direct and to the point. Additionally, Eastern European professionals are increasingly familiar with Western business practices and often possess a high level of English proficiency. This cultural alignment makes it easier for teams from both regions to collaborate effectively, understand each other’s expectations, and build strong working relationships based on mutual understanding and shared values.

The Advantages of Choosing Eastern Europe for Nearshoring

Selecting Eastern Europe as a nearshoring destination offers numerous advantages for US and Canadian businesses, addressing key concerns in the current global climate.

Enhancing Supply Chain Security and Flexibility

Nearshoring to Eastern Europe provides North American businesses with greater control over their supply chains compared to distant offshore locations. The closer proximity allows for easier monitoring of production processes and more direct communication with partners, ensuring better adherence to quality standards and a greater ability to respond quickly to supply chain issues. The reduced geographical distance also translates to shorter transportation times and more agile responses to changing market needs. Furthermore, while not entirely immune to geopolitical risks, Eastern Europe’s position within or close to the European Union and NATO offers a more stable and predictable environment compared to regions more directly impacted by major conflicts or volatile political landscapes.

Achieving Significant Cost Efficiencies

The lower cost of labor in Eastern Europe compared to the US and Canada is a primary driver for nearshoring. This cost advantage extends beyond just wages to include potential savings on operational costs, recruitment expenses, and overheads , making it a financially sound strategy for North American businesses.

Accessing a Rich and Diverse Talent Pool

Eastern Europe offers a vast and diverse talent pool with expertise in a wide range of technologies and industries. The region’s strong educational systems produce a continuous stream of graduates in fields critical to technology, manufacturing, and customer service, ensuring that North American businesses can find professionals with the specific skills and industry knowledge they require.

Accelerating Time-to-Market through Effective Collaboration

The combination of manageable time zone alignment and cultural compatibility between Eastern Europe and North America allows for seamless integration of nearshore teams with in-house staff. This leads to more efficient workflows, faster project completion times, and an overall acceleration of the time-to-market for products and services.

Your Company's Role in Facilitating Nearshoring to Eastern Europe

Our company specializes in facilitating seamless nearshoring transitions for European, US and Canadian businesses looking to establish a presence in Eastern Europe. We offer comprehensive services tailored to meet the unique needs of our clients.

- Expertise in Pod Creation for Tailored Development Teams: We have a proven methodology for creating dedicated, agile pods in Eastern Europe. These teams are carefully constructed to align with the specific technical and cultural requirements of your projects, providing a tailored and efficient development solution.

- Strategic Staff Augmentation Services to Meet Evolving Needs: Our staff augmentation services provide you with access to a vast pool of skilled IT professionals and domain experts across Eastern Europe. Whether you need to scale your existing team or require specific niche expertise, we can quickly and efficiently augment your North American workforce with top talent.

- Proven Recruiting Capabilities within the Eastern European Market: With an extensive network and deep understanding of the Eastern European job market, our recruiting services are designed to identify and attract top talent across various roles and industries. We handle the entire recruitment process, ensuring you have access to the best professionals the region has to offer.

Key Industries Primed for Nearshoring Success in Eastern Europe

Several industries stand to gain significant advantages by nearshoring their operations to Eastern Europe:

- Software Development and IT Services: The robust talent pool and competitive costs make Eastern Europe a prime destination for software development, web development, mobile app development, and various IT support services.

- Manufacturing: Lower labor costs and a skilled technical workforce in Eastern Europe offer a compelling alternative for North American companies looking to nearshore their manufacturing processes.

- Finance and FinTech: The region’s growing expertise in technology, coupled with cost-effectiveness, makes it an attractive location for nearshoring finance and FinTech operations, including software development, data analysis, and customer support.

- Healthcare and Life Sciences: Eastern Europe’s talent pool includes skilled professionals in research and development, as well as administrative and IT support, making it a viable option for nearshoring healthcare and life sciences operations.

- E-commerce and Retail: Nearshoring customer service, IT support, and even some aspects of supply chain management to Eastern Europe can offer cost savings and improved efficiency for e-commerce and retail businesses.

- Aerospace and Automotive: With a strong tradition in engineering, Eastern Europe presents opportunities for nearshoring manufacturing and R&D activities in the aerospace and automotive sectors.

- Customer Service and Technical Support: The multilingual and English-proficient workforce in Eastern Europe, combined with competitive labor costs, makes it an ideal location for nearshoring customer service and technical support functions.

Case Studies and Success Stories

Numerous US and Canadian companies have successfully leveraged nearshoring operations, including pod creation and staff augmentation, in Eastern Europe. These companies, spanning various industries, have reported significant benefits such as reduced development costs, faster time-to-market, access to specialized skills, and improved collaboration. The success stories underscore the strategic advantages of Eastern Europe as a nearshoring destination and highlight the potential for North American businesses to achieve their operational and strategic goals through partnerships in this dynamic region.

Addressing Potential Challenges and Ensuring a Smooth Transition

While nearshoring to Eastern Europe offers numerous advantages, it is important to acknowledge and address potential challenges to ensure a smooth transition. Cultural nuances, although less pronounced than with more distant offshore locations, still exist and require careful navigation. Establishing clear and consistent communication strategies that account for these differences is crucial for effective collaboration. Additionally, while generally stable, geopolitical considerations in certain parts of Eastern Europe should be taken into account.

To mitigate these challenges and ensure a successful nearshoring experience, partnering with an experienced firm like ours is highly recommended. We provide the expertise and local knowledge necessary to navigate cultural differences, establish effective communication channels, and understand the geopolitical landscape. Our proven processes for pod creation, staff augmentation, and recruiting within the Eastern European market are designed to align with the specific needs and expectations of US and Canadian businesses, facilitating a seamless and efficient transition.

Conclusion and Strategic Recommendations

In conclusion, the current global economic and political climate, marked by trade wars, geopolitical instability, and logistical challenges, presents a compelling imperative for US and Canadian businesses to adopt nearshoring strategies. Eastern Europe has emerged as a strategic anchor in this evolving landscape, offering a unique combination of economic resilience, a skilled and cost-competitive workforce, favorable time zone alignment, and increasing cultural compatibility.

For US and Canadian businesses seeking to enhance supply chain resilience, optimize operational costs, and access a rich and diverse talent pool, nearshoring to Eastern Europe represents a significant strategic advantage. The region’s positive economic outlook, coupled with its skilled workforce across various sectors, positions it as an ideal destination for companies looking to expand or relocate their operations closer to home while maintaining a global competitive edge.

We, as a specialist in facilitating nearshoring to Eastern Europe, are ideally positioned to guide US and Canadian businesses through this transition. Our expertise in pod creation, staff augmentation, and recruiting services within the Eastern European market ensures a seamless and successful experience. We understand the nuances of the region and are committed to providing tailored solutions that meet your specific needs and help you capitalize on the numerous benefits that Eastern Europe has to offer.

We strongly recommend that US and Canadian businesses to consider exploring the significant opportunities available in Eastern Europe. Engaging with our team will provide you with the expertise and support necessary to navigate the complexities of international expansion and establish a robust, efficient, and cost-effective presence in this dynamic and promising region. Contact us today to explore your nearshoring options and take the first step towards a more resilient and successful future for your business.